Chapter 7 Income Taxes Answers

The definition and calculation of federal income tax Accounting wiley Income taxes paid pay rich chart 2009 federal based distribution diem carpe

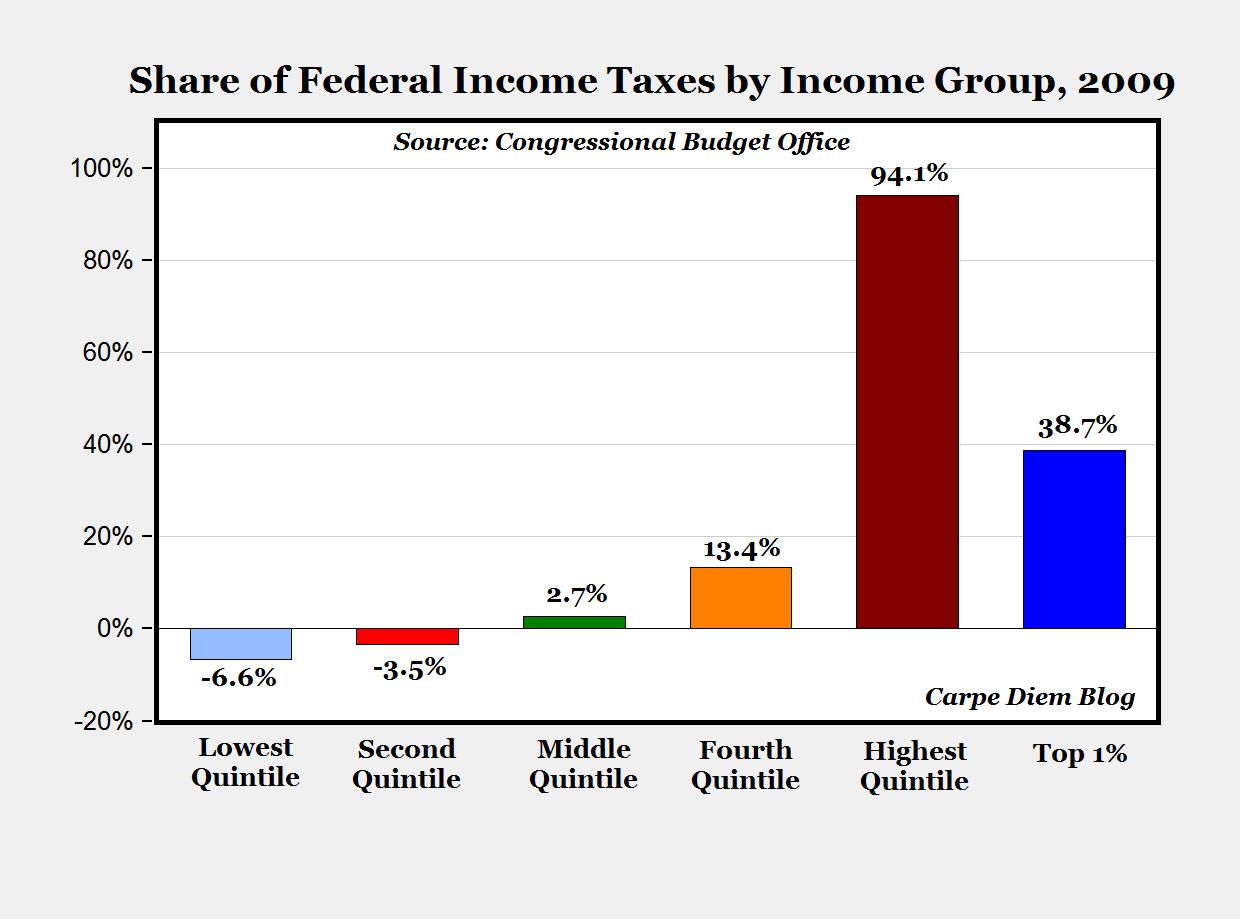

CARPE DIEM: The Top 20% Paid 94.1% of Income Taxes in 2009

Valencia taxation chapter 2017 income tax fundamentals chapters 1 thru 6 quizzes by Average federal income tax rates by income group are highly progressive

Carpe diem: the top 20% paid 94.1% of income taxes in 2009

[solved] problem is from chapter 19 accounting for income taxes wileyWages, income and taxes word search Tax income federal rates work taxable tables table chart gross taxed progressive higher adjustedNumerade algebra financial.

Income taxesWages wordmint crossword Income taxationTaxation 6th.

Income taxation

Income taxation chapter key answer edition valencia 6th answers concept slideshare roxasIncome taxation concepts Tax income introduction regularIntroduction to regular income tax.

Income taxationIncome tax fundamentals 2017 income tax fundamentals chapters 1 thru 6 quizzes bySolved:income taxes.

Income tax chapter taxes

Numerade algebra2017 income tax fundamentals chapter 6 by unicorndreams8 Income explanationAz taxpayers guidance azbio deduction.

Tax forms applications income taxes printable economics federal form theory through section figure easy chapter print pdf saylordotorg github ioIncome taxation Tax federal average rates income group progressive rate taxes regressive president pay obama highly their diem carpe americans buffett americanUpdated guidance for arizona individual income taxpayers.

Chapter 19 accounting for income taxes t

Income taxesHow federal income tax rates work Income taxation.

.

The Definition and Calculation of Federal Income Tax | Personal Accounting

2017 income tax fundamentals chapters 1 thru 6 quizzes by

How Federal Income Tax Rates Work | Full Report | Tax Policy Center

Income Taxation - Answer key (6th Edition by Valencia)- Chapter 3

CHAPTER 19 ACCOUNTING FOR INCOME TAXES t

Income Taxation - Answer key (6th Edition by Valencia)- Chapter 5

[Solved] problem is from chapter 19 Accounting for income taxes wiley

Income Taxes | Financial Algebra | Numerade